By CyberDudeBivash Pvt Ltd – Crypto Security, AI & Blockchain Infrastructure Ecosystem

Short Answer: It Depends on Who You Are and How You Trade

In 2026, memecoin trading is neither inherently stupid nor inherently smart.

It is context-dependent.

For some participants, memecoins are high-risk liquidity instruments that can be traded with discipline.

For others, they are financial traps disguised as fun.

At CyberDudeBivash, we don’t judge memecoins emotionally.

We judge them operationally.

So the real question isn’t:

“Are memecoins good or bad?”

It is:

“Am I equipped to trade them without self-destructing?”

1. Why Memecoins Still Exist in 2026

If memecoins were purely irrational, they would have disappeared long ago.

They didn’t — because they serve real (but narrow) functions:

- Liquidity acceleration

- Retail coordination

- Market sentiment signaling

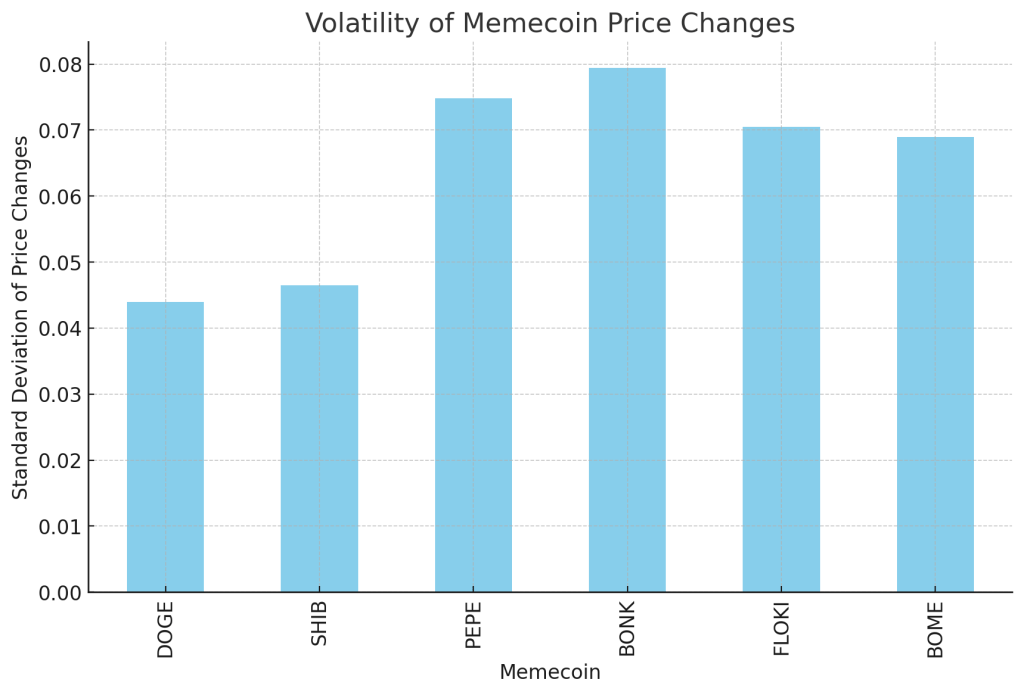

- Short-term volatility generation

Memecoins thrive during:

- Risk-on phases

- Retail re-entry cycles

- Low-barrier blockchains (like Solana)

They are tools, not investments.

2. What Changed About Memecoin Trading Since Earlier Cycles

Then (2019–2022)

- Few participants understood on-chain risk

- Rug pulls were obvious but frequent

- Liquidity was thin

- Tools were immature

Now (2026)

- Scams are more sophisticated

- Wallet drainers are common

- Liquidity forms faster

- Narratives rotate aggressively

- AI-assisted scams scale instantly

This means risk increased, not decreased.

Memecoin trading today requires more skill, not less.

3. When Trading Memecoins Can Be Rational

Trading memecoins in 2026 can make sense only if all of the following are true:

- You treat them as short-term trades, not beliefs

- You use isolated wallets with capped balances

- You define entries and exits before buying

- You accept total loss as a possible outcome

- You do not confuse luck with skill

Professionals don’t marry memecoins.

They rent volatility.

4. When Trading Memecoins Is a Bad Idea (Most People)

Memecoin trading is unwise if:

- You need the money

- You chase pumps

- You hold without an exit plan

- You trust social media signals

- You reuse your main wallet

- You ignore contract permissions

In these cases, memecoins are not trading instruments.

They are wealth transfer mechanisms.

5. The Security Reality No One Likes to Talk About

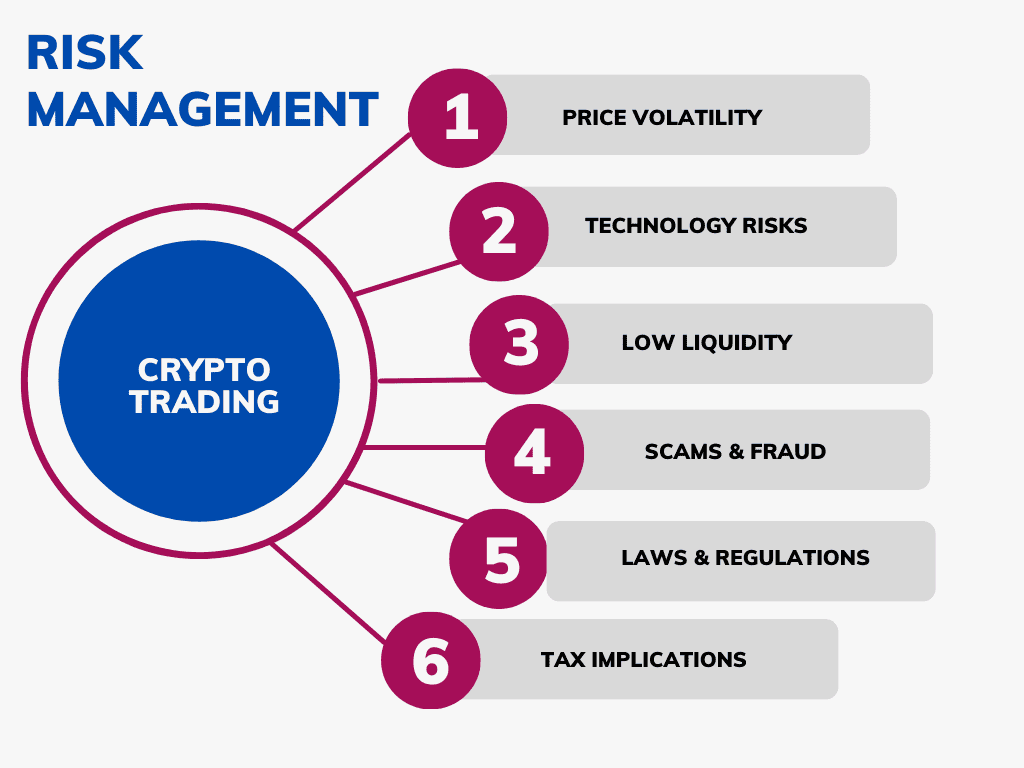

In 2026, memecoins are the #1 vector for crypto losses due to:

- Wallet approval drainers

- Fake airdrop sites

- Clone contracts

- Malicious frontends

- Social-engineering pressure

At CyberDudeBivash, we see a clear pattern:

The faster the hype, the lower the security hygiene.

This is why memecoin trading without security discipline is reckless.

6. Why Most People Lose Even When They “Win”

Many memecoin traders experience this cycle:

- Small win

- Increased confidence

- Larger position

- Reduced caution

- One bad trade

- Total drawdown

The problem is not the market.

It is position sizing and psychology.

Memecoins amplify emotion.

Emotion destroys strategy.

7. Memecoins vs Utility Altcoins (2026 Reality)

By 2026, markets clearly differentiate:

- Memecoins → Liquidity & sentiment

- Utility altcoins → Infrastructure & revenue

Smart participants:

- Trade memes tactically

- Allocate long-term capital to utility

Confusing these roles leads to poor outcomes.

8. The CyberDudeBivash Memecoin Trading Rules

If you choose to trade memecoins, follow these non-negotiable rules:

- Never trade from your main wallet

- Cap exposure per trade (small %)

- Use cold storage for profits

- Revoke approvals frequently

- Exit without ego

- Assume every meme can go to zero

Breaking any rule means you’re gambling, not trading.

9. The Hidden Cost: Time, Focus, and Stress

Even when memecoin trading is profitable, it costs:

- Attention

- Mental energy

- Sleep

- Focus

For many, this cost exceeds the reward.

This is why many experienced operators age out of meme trading, even when they understand it.

Final Verdict: Is It Wise to Trade Memecoins in 2026?

For most people? No.

For disciplined, security-aware traders who treat memes as volatility tools? Possibly.

Memecoins are not investments.

They are stress tests.

If you can’t pass the stress test, the market will take your capital.

Authority Call to Action

If you want to:

- Participate in crypto without self-destructing

- Understand when not to trade

- Build security-first habits

- Separate speculation from strategy

Explore the CyberDudeBivash ecosystem, where crypto is treated as adversarial systems, not entertainment.

Leave a comment