A Security-First, Discipline-Driven Operating System for Crypto Markets

By CyberDudeBivash Pvt Ltd – Crypto Security, AI & Blockchain Infrastructure Ecosystem

Why This Protocol Exists

Most traders don’t fail because they lack intelligence.

They fail because they lack a protocol.

By 2026, crypto markets are:

- Faster

- More adversarial

- More manipulated

- More automated

Trading without a strict operating system is no longer “risky” — it is structurally irresponsible.

The CyberDudeBivash Trading Protocol exists to answer one question:

How do you trade crypto in a way that survives volatility, scams, psychology, and your own mistakes?

This protocol prioritizes survival first, profit second.

Core Principle (Non-Negotiable)

You are not here to win every trade.

You are here to avoid the one trade that ends your ability to trade.

Everything below follows from this.

Capital Segmentation Protocol (MANDATORY)

Before a single trade:

- Trading capital is segregated from long-term holdings

- Trading wallet contains only risk capital

- Profits are swept out regularly to cold storage

- No DeFi experimentation from trading wallets

Rule:

If one wallet compromise can destroy your net worth, you are already broken.

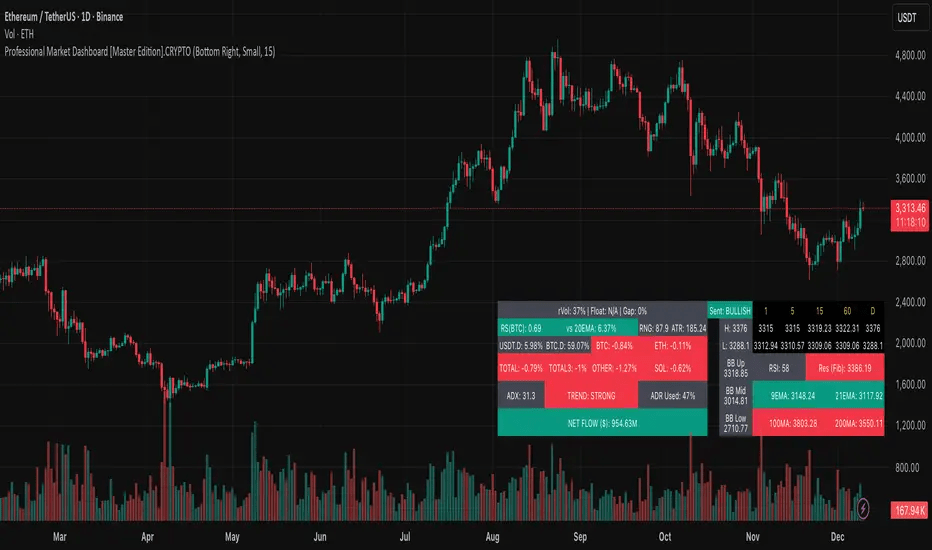

Market Participation Filter (When to Trade, When to Do Nothing)

You trade only if:

- Liquidity is present

- Volatility is readable (not chaotic)

- You understand why price is moving

- You can define risk before entry

You do not trade when:

- Price is driven purely by hype

- You feel urgency or FOMO

- You are reacting to social media

- You are tired, emotional, or distracted

Final rule:

No trade is always a valid trade.

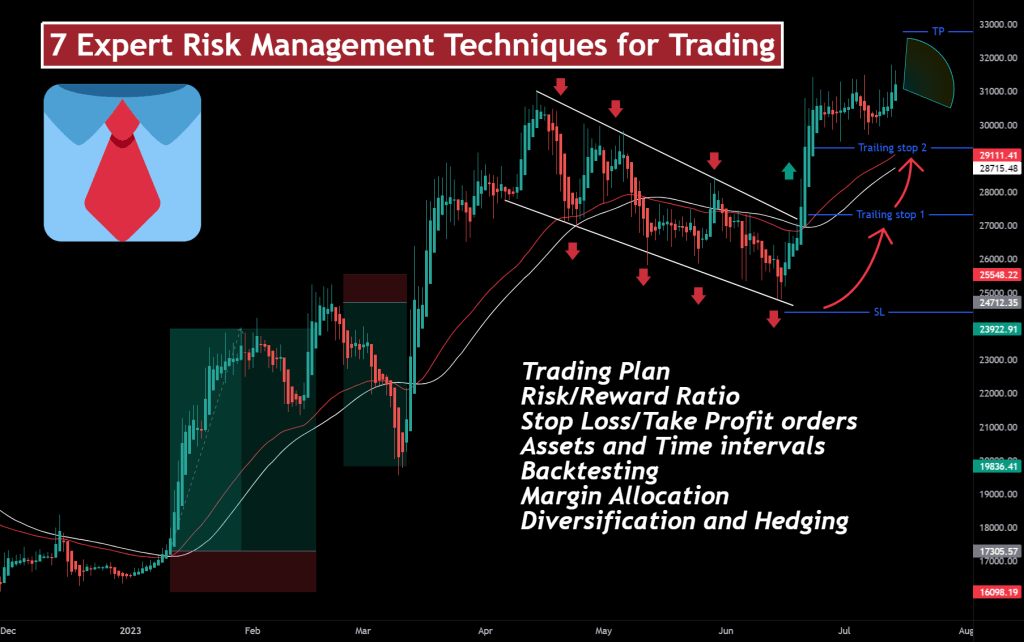

Position Sizing Protocol (The Real Edge)

Most traders blow up due to size, not direction.

CyberDudeBivash sizing rules:

- No single trade can cause emotional stress

- No position risks more than a small fixed %

- Losses are boring, not dramatic

- Wins are allowed to compound, not ego

If you need a trade to work, the size is wrong.

Entry Logic Protocol (No “Hope” Trades)

Every entry must have:

- A clear thesis

- A defined invalidation point

- A reason that survives 5 minutes of scrutiny

You never enter because:

- “It looks strong”

- “Everyone is talking about it”

- “I don’t want to miss it”

Hope is not a strategy.

Entries are decisions, not impulses.

Exit Protocol (Most Important Rule)

Exits are planned before entry.

- Stop loss is defined and accepted

- Partial profits are allowed

- Full exit is executed without negotiation

- No “revenge re-entries”

CyberDudeBivash rule:

If you hesitate to execute your stop, you are trading your ego, not the market.

Time Horizon Alignment Protocol

Every trade must declare its identity:

- Scalp (minutes–hours)

- Swing (days–weeks)

- Position trade (weeks–months)

You do not:

- Turn scalps into investments

- Turn investments into panic trades

- Change timeframes mid-trade

Timeframe confusion is silent capital bleed.

Memecoin Containment Protocol (2026 Reality)

Memecoins are treated as:

- Volatility instruments

- Liquidity experiments

- Sentiment signals

Rules:

- Separate wallet only

- Smaller size than utility trades

- Faster exits

- Zero attachment

Breaking this rule converts trading into gambling.

Security Protocol (Trading Is an Attack Surface)

Trading increases risk exposure.

Mandatory controls:

- Isolated browser profile

- Hardware wallet for approvals

- No blind signing

- Regular approval revocation

- No DMs, no “support” links

CyberDudeBivash axiom:

A profitable trader with poor security will eventually lose everything.

Loss Management Protocol (How You Lose Matters)

Losses are:

- Expected

- Controlled

- Documented

After a loss:

- No immediate re-entry

- Review logic, not outcome

- Reduce size if emotions rise

A trader who respects losses stays solvent.

A trader who fights losses exits the market permanently.

Psychology Override Protocol

You stop trading immediately if:

- You feel angry

- You feel euphoric

- You feel the need to “make it back”

- You stop following your rules

Discipline is not emotional strength.

It is rule obedience.

Performance Review Protocol (Weekly Only)

You review:

- Rule adherence (not P&L)

- Position sizing consistency

- Execution quality

- Security hygiene

If profits increase but discipline decreases, you are regressing.

The CyberDudeBivash Trading Law

Trading is not about being right.

It is about staying operational long enough for probability to work.

Most traders don’t fail spectacularly.

They fail slowly — by breaking small rules repeatedly.

This protocol exists to prevent that.

Final Authority Verdict

If you:

- Trade without rules

- Size emotionally

- Ignore security

- Chase narratives

The market will remove you.

If you:

- Follow a protocol

- Respect risk

- Accept boredom

- Protect capital

You earn the right to stay.

That is the real edge in 2026.

Authority Call to Action

If you want to:

- Trade without self-destructing

- Build a security-first trading system

- Separate discipline from emotion

- Operate like a professional

The CyberDudeBivash ecosystem exists to support traders who value longevity over screenshots.

Leave a comment