By CyberDudeBivash Pvt Ltd – Crypto Security, AI & Blockchain Infrastructure Ecosystem

Introduction: The Market Is Growing Up — Whether We Like It or Not

Memes dominated attention.

Utility is now dominating capital.

By 2026, crypto markets are no longer asking what is loudest — they are asking what lasts.

Meme coins had their moment. They were powerful, fast, and culturally explosive. But markets don’t evolve on entertainment alone. They evolve on reliability, usefulness, and survivability.

At CyberDudeBivash Pvt Ltd, we analyze crypto trends from a systems perspective. And the signal is clear:

Capital is rotating from narrative-only assets to utility-anchored altcoins.

This isn’t about memes “dying”.

It’s about utility finally being priced correctly.

1. Meme Coins Won the Attention War — Utility Wins the Capital War

Meme coins excel at:

- Capturing attention

- Coordinating retail behavior

- Accelerating short-term liquidity

But attention is volatile.

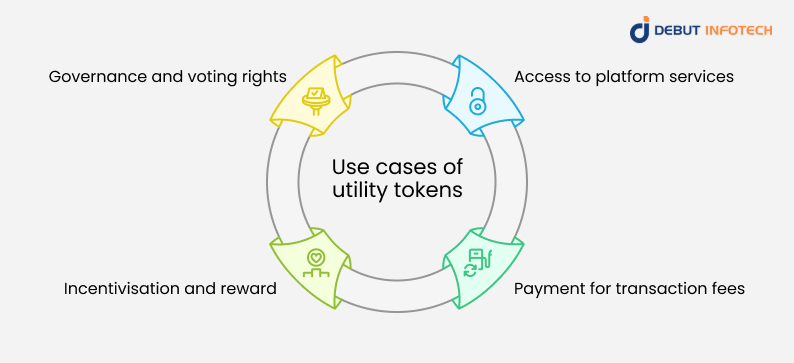

Utility altcoins excel at:

- Solving real problems

- Generating protocol revenue

- Supporting infrastructure

- Surviving regulatory scrutiny

Attention spikes markets.

Utility anchors them.

In 2026, anchoring matters more than spikes.

2. The Post-Hype Filter: What the Market Learned the Hard Way

After multiple cycles, markets learned three expensive lessons:

- Liquidity without purpose evaporates

- Communities without utility fragment

- Tokens without revenue bleed value

Utility altcoins survived because they:

- Serve developers

- Power applications

- Enable infrastructure

- Generate ongoing demand

This is not ideology.

It is market selection.

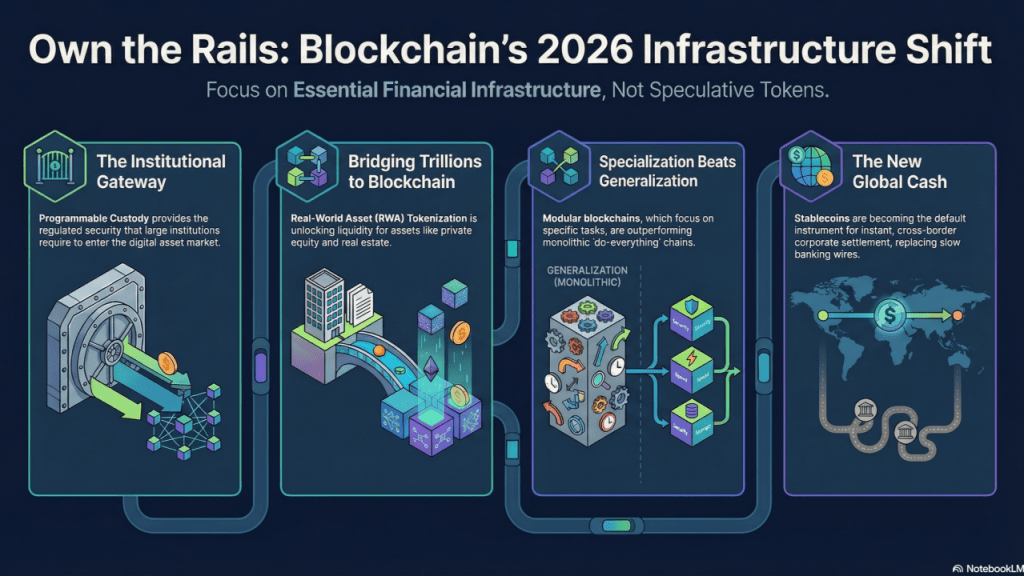

3. Why Institutions Don’t Chase Memes (But Watch Them Closely)

Institutions do not deploy serious capital into memes for one reason:

Memes cannot be underwritten.

You cannot model:

- Long-term demand

- Predictable cash flow

- Regulatory durability

- Operational necessity

Utility altcoins can be evaluated using:

- Usage metrics

- Fee generation

- Dependency graphs

- Integration depth

Institutions watch memes as sentiment indicators —

but they allocate to utility.

4. Regulation Accelerated the Shift (Quietly)

Regulation didn’t kill memes.

It simply:

- Raised compliance costs

- Increased accountability

- Penalized opacity

- Rewarded transparency

Utility altcoins adapted because:

- They already had documentation

- They already had users

- They already had structure

- They already had purpose

Memes struggle in regulated environments because they were never designed to explain themselves.

5. Developers Vote With Their Time — And They Chose Utility

Developers don’t build on memes.

They build on:

- Compute networks

- Data layers

- Identity systems

- Oracles

- Security tooling

- AI infrastructure

Utility altcoins attract:

- Long-term builders

- Tooling ecosystems

- Documentation

- Integration momentum

Where developers go, value follows — eventually.

CyberDudeBivash tracks this closely because developer gravity predicts future relevance.

6. Real Yield Changed the Conversation Permanently

The rise of real yield exposed a brutal truth:

If a token does not enable revenue, it cannot sustain yield.

Utility altcoins generate yield because:

- Users pay for services

- Protocols collect fees

- Infrastructure is consumed

Memes generate yield only through:

- Speculation

- Rotation

- New entrants

Once markets experienced real yield, it became impossible to unsee the difference.

7. Utility Altcoins Are Boring — And That’s the Advantage

Utility tokens are often criticized for being:

- Slow

- Unexciting

- Complex

- Hard to explain

That “boring” nature is precisely why they last.

Infrastructure is never exciting — until it fails.

By 2026, capital prefers:

- Stability over spectacle

- Usage over virality

- Survivability over screenshots

Boring compounds.

Exciting burns out.

8. Memes Still Matter — Just Not the Same Way

CyberDudeBivash does not dismiss memes entirely.

Memes now function as:

- Liquidity accelerators

- Risk-on indicators

- Market sentiment gauges

- Retail re-entry signals

But they are no longer the destination.

They are the weather, not the climate.

Utility altcoins are the climate.

9. The Security Factor Everyone Underestimates

Utility projects invest in:

- Audits

- Infrastructure security

- Operational resilience

- Incident response

Memes often:

- Ship fast

- Secure later (or never)

- Accept higher failure rates

In an era of constant exploits, security spend correlates with longevity.

CyberDudeBivash sees this repeatedly in incident analysis.

10. Capital Follows Survivability, Not Culture

Culture creates waves.

Survivability creates tides.

In 2026, capital is flowing toward:

- Networks that can’t disappear overnight

- Tokens required for operations

- Systems that can be regulated, audited, and defended

Utility altcoins fit this profile.

Memes do not — by design.

11. The CyberDudeBivash Market Rotation Thesis

Our internal thesis is simple:

- Memes dominate early and emotional phases

- Utility dominates late and institutional phases

- Infrastructure outlives narratives

The current rotation is not sudden.

It is overdue.

Final Verdict: Utility Isn’t Replacing Memes — It’s Outgrowing Them

Memes are not being “left behind” because they failed.

They’re being left behind because the market evolved.

Utility altcoins are winning because:

- They do real work

- They earn real fees

- They support real systems

- They survive real pressure

In 2026, crypto is no longer about what’s funniest.

It’s about what’s functional.

Authority Call to Action

If you want to:

- Understand market rotations before they trend

- Separate noise from infrastructure

- Build positions around utility, not hype

- Think like a long-term operator

Explore the CyberDudeBivash ecosystem, where crypto is analyzed as systems under pressure, not stories on a chart.

Leave a comment